That’s not fair is what you may exclaim when you learn that an Indian Start-Up with the Highest ever Series A funding in India was secured by CRED. You may repeat saying that when you learn that Cred has no (Negligible) revenue stream in two years of its operations. And finally you may stop reading this blog to check upon the facts on the internet when you learn that CRED has raised in total of USD 235 Mn in 2 years of its existence with no literature available on the internet about its Business or Revenue Model.

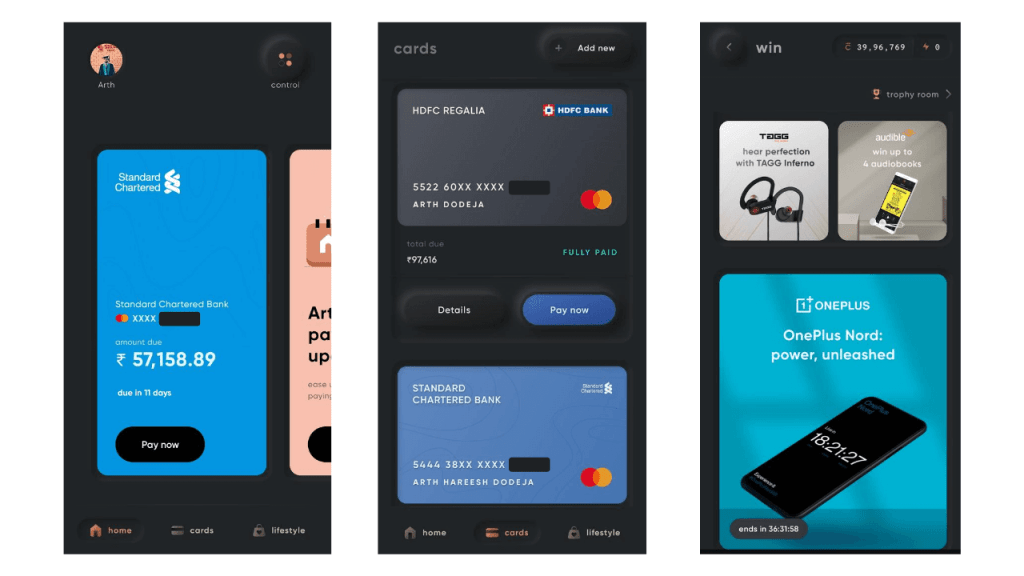

CRED is a mobile application that consolidates the amounts due on Credit Card and allows a convenient Credit Card Bill payment to it’s users. Launched in the Year 2018 by Kunal Shah. The Founder & CEO of Freecharge for a USD 400 Mn

Cred is a platform operational only on mobile application, the app allows users to be registered only if they are credible. The application captures the Mobile Number of the customers and uses it as an Unique ID and a mode of authentication. The application on the backend crawls through the list of credit cards post an acknowledgement by the users on the application. The program skims through the emails to highlight all the Credit Cards associated with the mobile number and the total dues on the credit cards.

The Application also checks the Credit Score of the registered user and allows users to transact on the application or be a part of the cred club only if their credit scores are higher than 750. The scores are mapped and available through CIBIL. The application uses the restrictive access to create the sense of privilege for the users. It markets itself by promoting to have on its platform people with high credit worthiness.

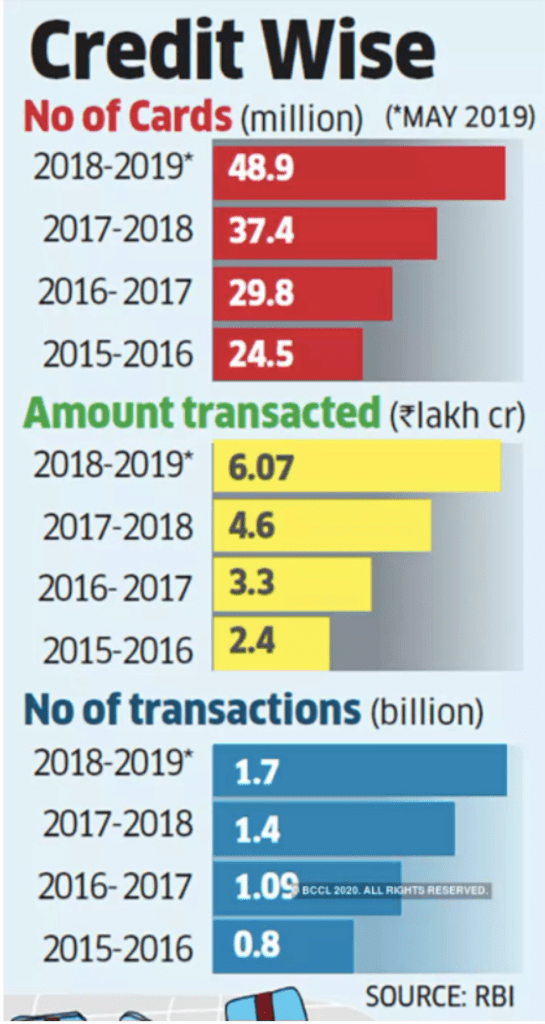

The chart illustrates the total number of credit card, total transaction and the value of transaction. Cred taps the 30% of the universe.

Revenue Model: As mentioned with the limited literature on the revenue model of the business, CRED earns a fee for using RENTPAY apart from revenue share from its Credit line offering. It also charges fee from brands to list their products on ‘Discover’ platform where the users can spend CRED coins to avail discount. The expected earnings against the above top source of income is near negligible. The platform allows the users to earn coins everytime the user pays the bill on time. These coins can be used to avail discount or tickets to raffle and jackpots through a lucky dip.

Having discussed the module of workings let’s understand the need for developing such an application which is currently valued at USD 800Mn. The application works on the concept of convenience it allows the customers to pay their credit card bills conveniently rewarding them with some coins.

The concept is actually tapping the human psychology of offering something which is nearly free but making the recipient privileged of the delivery. The creation of a FREENIUM offering. Looking closely on the list of options against which the coins could be redeemed shall make the user realize the utility or the non-utility of the products in offering. Here’s the thought process the customers feels privileged being part of a club virtually getting something which makes them feel empowered owing a virtual wealth.

In reality CRED is a promotional medium, which allows brands to advertise in lieu of offers they give to CRED in anticipation of a redemption. The only thumb rule is the offer has to be better than what is available in the market to avoid any customer dissonance. The better the offer the greater are the chances of being pushed through a prominent position on the application. Each offer has a certain burn of coins and then there are a few raffle where you can burn your coin to get a chance to win yourself a car, or a bike or a fancy mobile phone.

Haven’t we seen this module at shopping complexes or malls during festive forever in traditional retail, where each time a customer buys from any retailer. The retailer gives the raffle ticket with a number mentioned along with a date when the lucky draw will be announced. The prizes are as big as Cars, Bikes, Gold or cash. These sales promotions have been going on forever. Cred has given it a digital edge.

Cred has quickly built the platform, the engagement, the users, the transaction, the valuation and most importantly raised funds. This has been all swiftly done through big budget promotion, marketing callouts and a constant emphasize. Cred recently spent over INR 75 Crores on a near 2 month cricketing bonanza played in Dubai, the Dream11 IPL.

Cred marketed a rather differentiated advertising onboarding celebrities & filmstar of the yesteryear. The ad promoted with a tagline as their business callout : NOT EVERYONE WILL GET. The ad ridicules the protagonist to share the Brand Call-out.

Pay them & Mock Them seems have connected well with the audiences too, just like the meme the promotional world of advertising also sees a direct connect. Some stats tweeted by Cred Investors Sequoia Capital states that the campaign has given a jump in their signup by 6X;

The TVC is being pushed with a newspaper advertisement across national dailies. The spends even in these time have been like never before to ensure that the app captures more users. A possible anticipation that with the slowdown and lower earning, people are living on Credit cards.

However the paradox of greed is that there is nothing called enough. The cost of acquiring a customer will be continue to grow if the lure to retain reduces. Marketing is an amplification, making a product look good, but in the end it all comes to the deliverables from the product. Marketing can manage the positioning for the product to charge the premium but with a deliverable worthy of the premiumness.

Cred is a Fintech & technology company having a business model same as Chinese company 51 CREDIT which has been a success story they however altered their workings venturing into its own credit offering & others. Cred currently seems to be focussing on the Enroll now! Will figure and ensure that you Pay Later Model.

Only time will unfold the real business model that Cred follows which is currently known to the handful investors who have pumped it all to keep them going full throttle.

For now I am struggling to burn my coins on CRED.

-XX-